How to Set Up a Successful Prop Trading Business: Step-by-Step Guide

Setting up a proprietary (prop) trading business can be a rewarding endeavor for experienced traders and entrepreneurs alike. The key to a successful prop trading firm is having the right tools, a sound strategy, and robust technology.

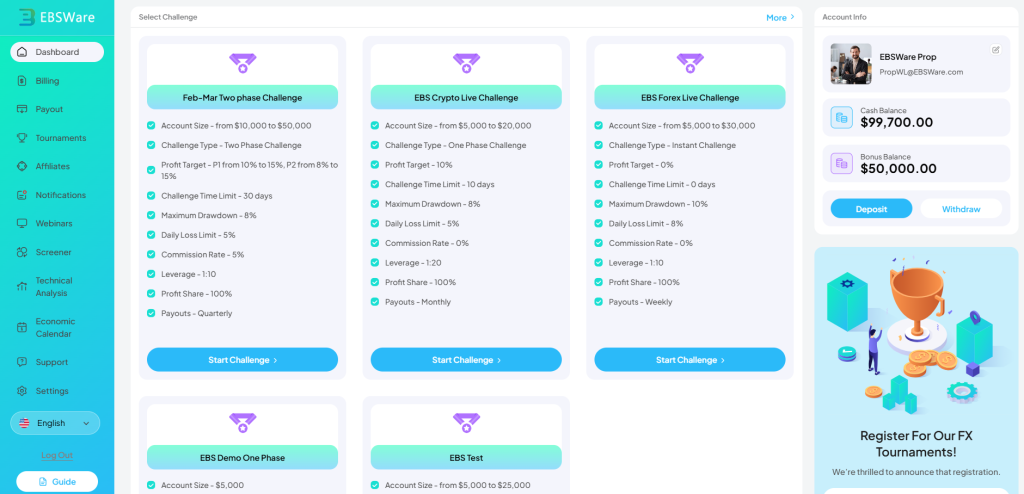

In this guide, we’ll walk you through how to set up a prop trading firm, leveraging EBSWare’s innovative solutions to streamline the process.

1. Understanding the Basics of Prop Trading

Proprietary trading involves a firm using its own capital to trade financial instruments, such as stocks, forex, commodities, and cryptocurrencies. Unlike traditional investment models, prop firms take on risk themselves, aiming to profit from their trading strategies. The key advantages of prop trading include:

- Control Over Risk: Prop traders have full control over their trading strategies and risk exposure.

- Higher Potential Returns: With the right strategy and risk management, prop trading can deliver high returns.

- Scalability: Prop firms can grow quickly by leveraging capital from investors or expanding trading strategies.

2. Choose the Right Trading Platform

To manage and execute trades effectively, you’ll need a high-quality, versatile trading platform. EBSWare’s xTrader platform is the ideal choice for setting up a prop trading firm.

- Multi-Asset Trading: xTrader supports multiple asset classes, including forex, stocks, commodities, and cryptocurrencies, enabling your firm to diversify its trading activities.

- Real-Time Market Data: Stay ahead of the competition with accurate and timely market data.

- Automated Trading Tools: Utilize advanced algorithms and strategies for efficient, automated trading.

3. Set Up a Robust Risk Management System

Risk management is one of the most important aspects of any trading business. Prop trading is inherently risky, and without a solid risk management system in place, even the best strategies can lead to significant losses.

- Automated Risk Management Tools: With EBSWare Prop, you get built-in risk management tools that help monitor and control exposure in real-time. You can set stop-loss orders, monitor margin levels, and create automated strategies to prevent excessive risk.

- Customizable Settings: Tailor the platform’s risk management tools to fit your firm’s specific needs, whether it’s for a single trader or a whole team.

4. Create a Trading Strategy

A well-defined trading strategy is essential for success in prop trading. This strategy will guide the firm’s trading activities, including which assets to trade, entry and exit points, and risk parameters.

- Quantitative Strategies: Many prop firms rely on quantitative models that analyze market data to predict price movements and inform trades.

- Discretionary Trading: Some firms prefer discretionary trading, where traders use their judgment and experience to make decisions based on market analysis.

Regardless of the strategy, it’s important to continuously refine and optimize it based on market conditions and performance feedback.

5. Develop a Strong Team

While you can start a prop trading firm as an individual, having a team of skilled traders, analysts, and risk managers will provide a competitive advantage.

- Traders: Experienced traders are essential to implementing and optimizing trading strategies.

- Risk Managers: Dedicated professionals who oversee the risk management systems and ensure compliance with internal and external regulations.

- Support Staff: From compliance officers to tech support, having a solid back office will keep operations running smoothly.

6. Leverage EBSWare’s White-Label Solutions for Scalability

To scale your prop trading firm efficiently, EBSWare offers white-label solutions that enable brokers and financial institutions to rapidly deploy and customize trading platforms without having to build everything from scratch.

- Customizable Branding: With EBSWare Prop, you can launch a fully branded platform tailored to your firm’s needs.

- Seamless Integration: Easily integrate third-party tools, data feeds, and payment systems into your platform.

- End-to-End Support: From setup to ongoing maintenance, EBSWare provides comprehensive support, allowing your firm to focus on trading rather than technical issues.

7. Ensure Compliance and Regulatory Adherence

Operating a prop trading firm involves adhering to regulatory requirements that can vary by region. Depending on where your firm is based, you may need to comply with local regulations regarding capital requirements, reporting standards, and trading practices.

- EBSWare’s Compliance Tools: EBSWare’s solutions include features that help you stay compliant with industry regulations, including audit trails, transaction reporting, and secure data management.

8. Market Your Prop Trading Firm

Once your firm is set up and operational, you’ll need to attract capital, clients, and partners. Consider the following marketing strategies:

- Create a Professional Website: Showcase your trading strategies, performance, and services to attract potential investors.

- Engage on Social Media: Build a presence on platforms like LinkedIn, Twitter, and financial forums to engage with potential clients and investors.

- Leverage SEO and Content Marketing: Write informative blog posts, whitepapers, and case studies that demonstrate your firm’s expertise and success.

9. Monitor Performance and Continuously Improve

After launching your prop trading firm, regularly monitor your trading performance to identify areas for improvement. Utilize the analytical tools in EBSWare’s xTrader and EBSWare Prop to track profits, losses, and overall performance.

- Adjust Trading Strategies: Based on performance metrics, tweak your strategies to enhance profitability.

- Optimize Risk Management: Continuously review and adjust risk parameters to maintain the firm’s stability.

Make Your Prop Trading More Efficient

Boost your trading efficiency, reduce risks, and increase profitability with EBSWare’s automated platform. Join us now to experience an all-in-one proprietary trading solution.

Contact Us for More Information