Forex Compliance and Regulation 2025: Key Markets and Broker Insights

In an increasingly digitized and globalized financial world, the foreign exchange (Forex/FX) trading industry has undergone substantial transformation. Alongside the growth of this multi-trillion-dollar market comes a wave of global regulatory reforms aimed at fostering market transparency, investor protection, and systemic stability. In this article, we explore the key impacts of regulatory shifts, major jurisdictional trends, emerging technologies, and how EBSWare is enabling brokers to stay compliant and competitive.

The Global Landscape of Forex Regulation

Historically, Forex was regarded as a loosely regulated, decentralized market. But over the past decade, financial crises and misconduct incidents have pushed regulators to tighten oversight. Today, a new global standard is emerging:

- Mitigation of systemic risk through leverage caps and liquidity controls

- Increased transparency via trade reporting and real-time disclosures

- Investor protection through restrictions on high-risk instruments and improved dispute mechanisms

These efforts are creating a safer, more professional market, but they also raise the bar for brokers and platforms to meet stringent compliance requirements.

Key Jurisdictions and Their Regulatory Stances

United States – Enforcement-Driven Compliance

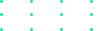

The U.S. Forex market is under the watchful eyes of the CFTC and NFA, emphasizing transparency, anti-money laundering (AML), and restrictions on retail leverage (e.g., 50:1 for major pairs). Non-compliant platforms face heavy penalties and market exclusion.

European Union – Harmonized Oversight with MiFID II

The EU’s MiFID II framework enforces unified rules across member states, including trade transparency, client categorization, and reporting obligations. The ESMA has implemented leverage limits (30:1 for retail), and product intervention powers are frequently exercised.

Asia-Pacific – Innovation-Friendly Yet Guarded

Jurisdictions like Singapore (MAS) and Hong Kong (SFC) have balanced innovation with consumer safeguards. Their tiered licensing systems allow for sandbox experimentation while ensuring capital adequacy and data security. Meanwhile, emerging markets are gradually enhancing regulatory sophistication by adopting best practices.

Emerging Trends in RegTech and Compliance Innovation

The rise of technology has transformed compliance from a cost center into a strategic advantage. Key developments include:

- AI-powered surveillance for fraud detection and market abuse

- Blockchain-based audit trails improving record transparency and traceability

- Real-time trade reporting tools integrated with regulatory APIs

- Cross-border compliance engines that adapt to regional requirements automatically

These solutions are enabling faster onboarding, lower operational risk, and dynamic adaptation to regulatory updates.

How EBSWare Supports Brokers in a Regulated World

At EBSWare, we understand that regulatory uncertainty can be a barrier to growth—but also a catalyst for innovation. Our platform is designed to help brokers:

- Stay compliant across jurisdictions with modular, region-specific configurations

- Automate AML/KYC workflows and data validation

- Maintain detailed audit trails and trade logs for reporting

- Implement risk management rules to meet leverage and exposure guidelines

Whether you’re launching in a heavily regulated market or entering a new region, our white label and proprietary solutions are built for the modern regulatory environment.

Looking Ahead – Regulation as a Growth Enabler

While stricter regulations increase operational overhead, they also open doors to more serious institutional participants, better investor trust, and sustainable business models. The future will likely bring:

- Tighter data residency and privacy rules

- Expansion of cross-border licensing frameworks

- Real-time regulatory audits powered by API integration

- Closer collaboration between tech providers and regulators

By embracing compliance as a competitive differentiator, brokers and platforms can future-proof their business and build long-term credibility.

The impact of global regulations on Forex trading is profound, reshaping how brokers operate, how investors engage, and how trust is earned. EBSWare remains committed to delivering compliance-ready solutions that help you scale globally without compromising on regulatory integrity.

Ready to build a broker platform that’s both fast and compliant? Contact EBSWare today.